Assignment

Achievement

Hire Experts

Reviews

Free Services

Grades

Offers

Order Now

Table of Contents

50,000+

Orders Delivered

4.9/5.0

Star Rating

100%

on-time delivery

24 x 7

Query Resolution

100 +

Subjects Catered

Our Experts

Reviews

Free Assignment Services

☞Title Pages - 100 Words

$05.00 free

☞Downloading Free Guide

$20.00 free

☞Upload Completed Tasks

$20.00 free

☞Genuine Content Report

$20.00 free

☞Consultation By Experts

$06.00 free

☞Unrestricted Revisions

$10.00 free

☞Grammar Check for Task

$25.00 free

☞Plagiarism Inspections

$25.00 free

Book Now and get Free Services Upto $0.00

Grades

Offers

1. PLACE YOUR ORDER

Whenever you fill out their order form, please read it carefully and then fill it out.

2. MAKE PAYMENT

Choose our secure payment method to pay for your order and collect your order from us with security.

3. GET YOUR DOCUMENT

Our writers write you plagiarism-free assignments and provide them to you before the deadline.

Our Experts

Search Assignments

Customers Reviews

The tax collection system is the cornerstone of any robust economy. The taxes collected are not just numbers; they are vital resources that are reinvested into public welfare. The efficiency of a nation's tax collection directly correlates with its economic vitality. A superior tax system translates to enhanced public services, making it imperative for individuals to actively engage in discussions about tax reform.

Every nation recognizes the importance of streamlining its tax collection system. Taxes provide a reliable revenue stream for the government, which fuels economic growth. In India, we see a mix of direct taxes, such as income tax, and indirect taxes, like GST.

However, challenges emerge when a tax system becomes overly reliant on a single type of tax. This is evident in the Indian economy, where income tax—including personal and corporate tax—has surged dramatically in the past five years. It's striking that income tax from salaried individuals, who represent just 2% of taxpayers, contributes twice as much as tax collected from large corporations.

To rectify this imbalance, Indian Finance Minister Nirmala Sitaraman has taken decisive action by introducing new income tax slabs in the Union Budget 2025. This move is crucial for creating a fairer and more equitable tax system that benefits all citizens.

There has been a significant amount of discussion and humor surrounding the Indian finance minister, particularly in relation to her tax policies. While some memes highlight frustrations with the tax burden on citizens, it's important to remember that a comprehensive understanding of our economy requires an interest in budgeting and taxation. Engaging with these subjects can lead to more informed perspectives on the challenges and opportunities within our economic system. Rather than relying on surface-level speculation, delving deeper into these topics can foster constructive dialogue and promote a better understanding of fiscal policies and their impacts.

The income tax changes compared to the old tax slab are summarized in the table.

|

Tax Rate (%) |

New Salary Slab (2024-25)(in lakhs) |

Old Salary Slab (2023-24)(in lakhs) |

|

Nil |

Up to 3 |

Up to 3 |

|

5% |

3 to 7 |

3 to 6 |

|

10% |

7 to 10 |

6 to 9 |

|

15% |

10 to 12 |

9 to 12 |

|

20% |

12 to 15 |

12 to 15 |

|

30% |

Above 15 |

Above 15 |

A significant change is noted in the income slabs for 5% and 10%. The slab size has increased. Earnings between ₹6,00,001 and ₹7,00,000 are now taxed at 5% rather than 10%. This will result in a monthly savings of ₹417 or almost ₹5,000 annually. It’s a welcome change, but ₹417/ month doesn't go very far when inflation drives up the cost of everything from groceries to rent.

Salaried employees only account for 2.2% of India's population. Yet, they are bearing twice the tax burden as an average Indian. They pay both income tax and GST on practically everything they buy. Meanwhile, business taxpayers pay only one type of tax: corporate income tax. Individual income tax revenues typically outperform corporate tax receipts. This disparity is widening, placing a tremendous strain on paid workers.

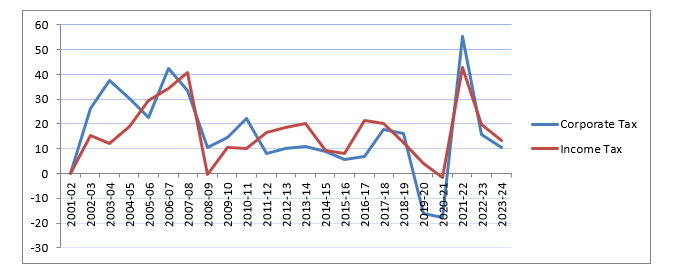

The Indian government has reduced corporate income tax rates to boost private sector growth and attract foreign direct investment. However, personal income tax (PIT) rates have stagnated, and marginal increases have been seen in specific income brackets. The key trends are as follows:

Shockingly, salaried employees pay more taxes than the corporations they work for. While companies enjoy reduced tax rates designed to boost investments, employees—especially middle-class workers—shoulder the heavier burden. And it doesn't stop at income tax. Salaried employees also pay GST on nearly everything they buy, getting taxed twice.

The situation feels even more unfair when you consider that companies have seen record profits recently—some hitting 15-year highs. Despite this, income has failed to maintain pace with inflation. For the taxpaying middle class, this means less money to deal with rising inflation. Groceries, petrol, and rent all increase prices, but earnings do not. It leaves consumers with less money to spend and save.

And it isn’t just a personal problem anymore; it is affecting the entire economy. In July-September, India grew 5.4%, but consumption growth has declined since last year. This decline is a direct result of the tax disparities that are putting a strain on the middle class and hindering economic growth. In short, while corporations enjoy tax breaks, the middle class literally pays the price. The system feels increasingly out of balance, and ordinary workers are bearing the brunt of it.

The recent adjustments to the income tax slabs, while modest, represent a positive direction. However, there is further work to be done to alleviate the financial challenges that India's middle class encounters. To foster a more equitable tax system, it is essential for the government to ensure that the tax burden is distributed fairly across all segments of society. This means encouraging corporations and higher-income groups to contribute their fair share, while also addressing the issue of double taxation that many salaried employees experience.

Adopting a more balanced approach to tax collection will not only enhance fairness but also support sustainable economic growth. With ongoing advocacy and heightened awareness, we can move towards a more just tax framework. Though salaried employees may feel some pressure in the interim, there is a shared vision for a more promising and equitable future ahead.

Disclaimer: all content and intellectual property remain the exclusive property of value Assignment Help

No Comments